Vesting

Vesting is a key concept, but many people are not familiar with the benefits of this important milestone. This gap in knowledge can cause you to unknowingly limit your retirement savings significantly and forfeit your access to a lifetime benefit.

Vesting is a key concept, but many people are not familiar with the benefits of this important milestone. This gap in knowledge can cause you to unknowingly limit your retirement savings significantly and forfeit your access to a lifetime benefit.

What is Vesting?

Vesting is a legal term that means to earn a right to a future benefit. Though all Georgia public school education professionals are automatically enrolled into TRS, our members must be vested in order to be eligible for a future pension.

Vesting is an important milestone because:

- you will be eligible to receive a monthly benefit upon reaching age 60, even if you do not earn additional creditable service;

- your primary beneficiary will be eligible to receive a monthly benefit upon your death if you have an active TRS account; and,

- you are eligible to apply for disability retirement as an active TRS member.

Get inVESTED with TRS

Like most plans, TRS requires a minimum number of years of service before a member is entitled to receive a benefit.

Vesting at TRS occurs when a TRS member has earned 10 years of creditable service.

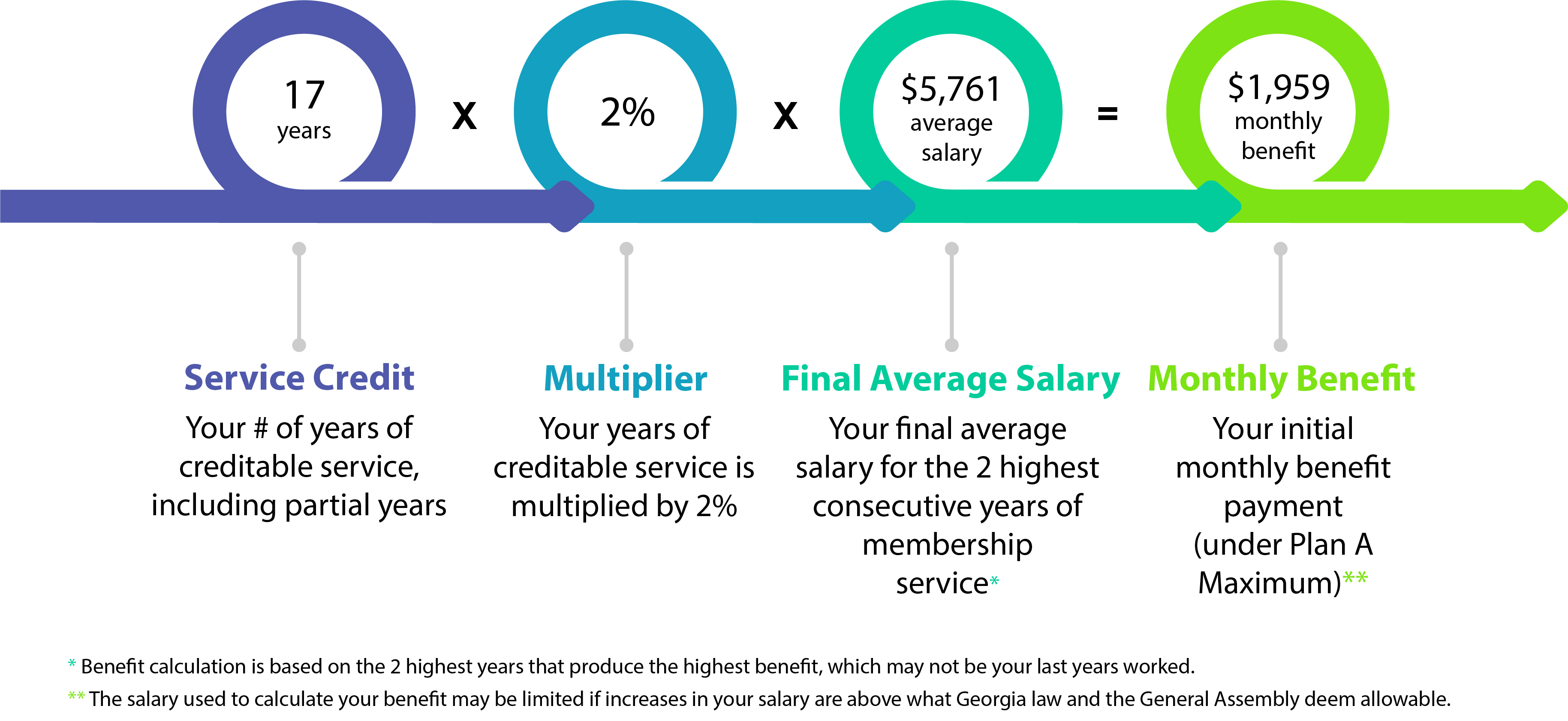

Once you are 60 years old with at least 10 years of service credit or achieve 30 years of service credit, you are eligible to retire. The TRS retirement plan is determined by a formula based on your years of service and/or age and your final average salary (see example below), and is guaranteed to last for your lifetime.

**The salary used to calculate your benefit may be limited if increases in your salary are above what Georgia law deems allowable.

What Happens if I Withdraw My Contributions from TRS?

If you are thinking about switching careers, moving out of state, or taking a break from education, it may sound tempting to withdraw your funds and receive a lump-sum payment of your contributions and interest. However that decision may come back to haunt you when you're ready to enjoy those golden years in retirement.

Please consider the following before you make that irrevocable decision.

Still Have Questions?

Over the years, we have witnessed too many members requesting refunds of their contributions and interest after vesting; not only losing their employer contributions, but forfeiting a monthly benefit at age 60 for the rest of their lives. If you are vested, before you cash out and give up what could be a substantial piece of your retirement income, please contact us at TRS to discuss your options.