Planning for retirement needs to be a priority for our members – the earlier they start, the better off they will be!

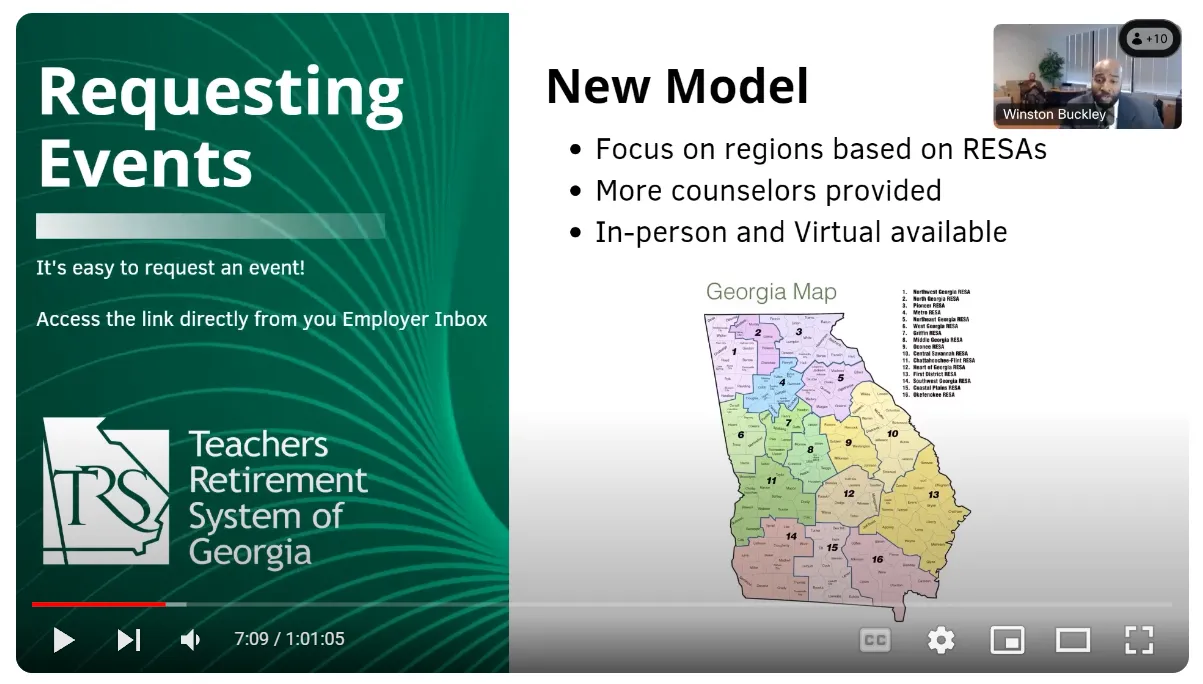

If you are a TRS-covered employer and would like to schedule an event at or near your location, please view the video and map for scheduling information and make a request through your employer account.

If they are planning to retire in the near future, how will they make the most of their freedom, choice, and opportunities available to them?

How much thought has been given to the life and lifestyle transitions that retirement will bring? Are the members aware of the potential pitfalls associated with retirement and do they have strategies to overcome them? How will they make the choices prior to and during retirement they need to make in order to create a successful retirement?

In order to assist the member with retirement planning, we offer three presentations geared towards the new hire, mid-career, and pre-retirement employees, and we offer one-on-one pre-retirement counseling sessions.

How do I confirm if a communication I receive or event is officially from TRS?

Contact us if you receive solicitations you are unsure about at trsevents@trsga.com or 404-352-6500. For additional information, you may download a copy of the TRS information and harmful practices letter.