At retirement, TRS members can establish credit for unused sick leave earned with current and previous TRS employers. If you haven’t been saving your sick leave up until now, you really should start. The more unused sick leave days you have at retirement, the earlier you can retire and the larger your monthly benefit.

Unused Sick Leave Eligibility

Based on Georgia law, an active member of TRS can receive credit for unused sick leave at retirement only if he or she has not received payment of any kind for the leave.

As a member of TRS, you may establish sick leave credit at the time of retirement provided that you have a combined minimum of 60 days of unused sick leave, for which you have not been paid, from your current and all previous TRS covered employers. You must have earned the sick leave while in a TRS covered position.

Attendance Incentives

Attendance incentives of any amount paid at any point during employment may reduce unused sick leave days reported to TRS for service credit. Programs that offer multiple payment amounts based on the number of sick days will reduce sick leave days reported to TRS. Payments based on any attendance incentive program offered through your school system that are not based on any variable number of sick leave days, are allowed and the number of unused sick leave days reported to TRS would not be affected.

Awarding of Credit

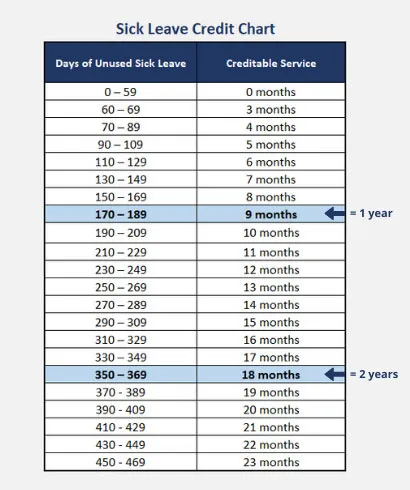

Typically, for every 20 days of unused sick leave you accumulate while working in a TRS covered position, TRS awards one month of service credit. Nine months of unused sick leave is equal to one year of service credit, regardless of the number of months worked per year. You must accumulate at least 60 days of unused sick leave to qualify.

TRS calculates sick leave credit only after receiving Sick Leave Certification forms from all of your TRS covered employers. Your current/final employer must submit the form after your last day of work. However, your previous employers may submit the form at any time. We recommend that you provide all of your previous employers with the form well in advance of your retirement date. This will expedite the processing of your unused sick leave credit at retirement.

Sick Leave Limitations

Unused sick leave credit is allowed for Georgia teaching service, including repurchased Georgia teaching service and service transferred from local retirement plans. Georgia law, however, does not permit the awarding of unused sick leave credit for the following service:

- Out-of-State

- Military

- Maternity Leave

- Air Time

- Study Leave

- Employees’ Retirement System of Georgia

- Private School

- Public School Employees Retirement System

Creditable sick leave accumulates at a maximum rate of 1¼ days per month.

- If you worked in a system which awards more than 1¼ days per month, your earned total will be reduced by TRS to meet this standard.

- If you worked in a system which awards less than 1¼ days per month, no adjustment will be made.

While sick leave credit cannot be used to achieve a vested status, it can be added to your creditable service at the time of your retirement. Total creditable service cannot exceed a maximum of 40 years. Also, credit cannot be established if you do not have at least 60 days of unused, unpaid sick leave.

When Sick Leave Records Do Not Exist

For the years when sick leave records are not available, TRS will calculate the average sick leave for the years when accurate records are available. This average will then be applied to the years for which records are unavailable.

For example

John worked 26 years in a position covered by TRS. The first 10 years he worked for Employer A and no records were kept. The last 16 years, he worked for Employer B whose records show that he retained 100 days of sick leave during his employment.

Calculation to determine the first 10 years of unused sick leave

- 100 days / 16 years = 6.25 days per year

- 6.25 days per year x 10 years = 62.5 days

- 62.5 days + 100 days = 162.5 total days

- 162.5 days = 8 months of unused sick leave

Reporting Your Unused Sick Leave

At the time you apply for retirement, your current and past employers must certify your total unused sick leave balance on a Sick Leave Certification form. Each employer is responsible for reporting to TRS and detailing the unused sick leave or verifying its lack of records (see “When Sick Leave Records Do Not Exist” section on the previous panel).

In order to issue a timely first monthly benefit, you will begin receiving a monthly benefit prior to the application of sick leave credit to your account. In this instance, your benefit will be adjusted retroactively to your retirement date upon receipt of forms from all employers.

NOTE: If you are under age 60 and plan to use sick leave credit to reach a penalty-free retirement status, (i.e., you have 29 years of service and believe you have one year of unused sick leave credit to obtain 30 years of service) you are encouraged to contact TRS for an estimate of your unused sick leave credit prior to retirement. In order to provide an estimate of unused sick leave credit, TRS must receive a Sick Leave Certification form from all Georgia employers. In this case, the current employer would submit an estimated balance of unused sick leave for the calculation and then submit a final balance after the retirement date.

TRS cannot guarantee that your estimated and final balances will be the same. Remember, it will only be an estimate.