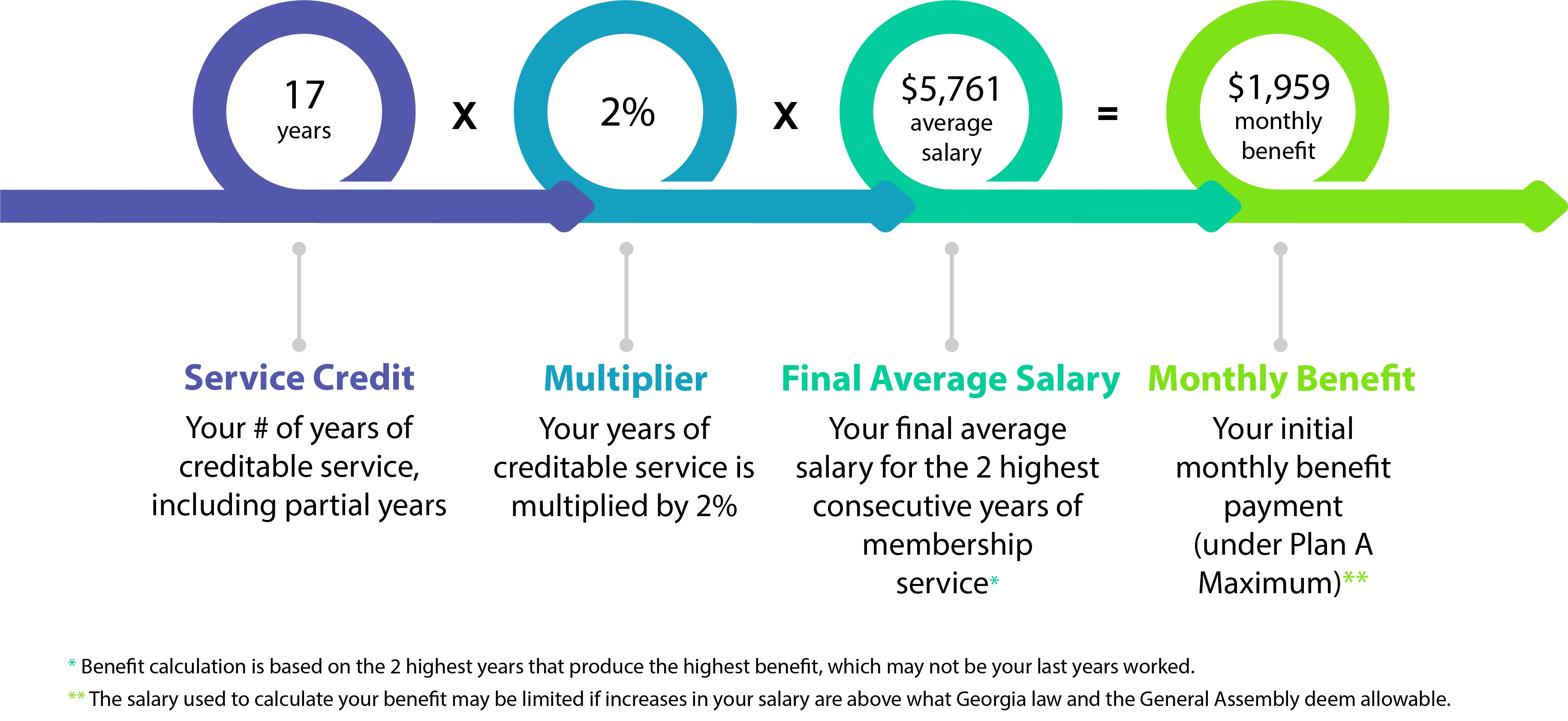

Your retirement benefit is calculated by using the percentage of salary formula. Simply stated, two percent is multiplied by your years of creditable service, including partial years (not to exceed 40 years). This product is then multiplied by your average monthly salary for your two highest consecutive years of membership service. Your benefit calculation is based on the 2 highest consecutive years of membership service that produce the highest benefit, which may not be your last years worked. The salary used to calculate your benefit may be limited if increases in your salary are above what is allowed by Georgia law.

Related.

- Maximizing Your Benefit

- Calculating Your Benefit

- Retirement Benefit Options

- Service Credit

- Unused Sick Leave Credit at Retirement

- Vesting

- Active vs Inactive Accounts

- Leaving Funds with TRS or Withdrawing Your Funds

- Annual Member Statement

- Life Changes

- Beneficiaries

- At Your Death – Survivor’s Benefits

- Disability Retirement

- Risk & Debt Management

- Insurance

- Supplementing Your TRS Benefit